In order to stick to our budget over the last several months, we have learned to do more with less. Here are some of the tips and tricks that have been essential to our survival:

1) Plan for Specials: When we do dine out, we utilize our neighborhood specials. $5 burger night? $6 taco night? $4 nacho platter? We use

Small Tabs to check out local specials, and frequent spots that offer weekly specials. It seriously saves us an incredible amount of money. Dinner for two for $10?! You can't beat it. This allows us to still spend quality time together sharing a meal {which we love to do} for a fraction of the cost.

2) Organize (yourself and your finances): Use

Mint.com - I've said it before, and I will repeat: Mint.com is an excellent tool to motivate budget and goal-setting. It allows you to literally set up goals such as paying off debt, setting up a savings account, and it measures your success. It also has archives full of financial planning resources. We use this website to track our goals. Mint.com even sends you "congratulations" emails when you've met a goal. So cool!

3) Get creative with cutbacks: Since we are driving our car less and less, but still paying insurance and fees {like that pesky City sticker}, we are planning to sell it. As an alternative, we joined

Zipcar's car-sharing program. My employer offers free membership and discounted rates for employees. It's a win-win. If we use it, we pay; if we don't use it, we don't pay.

4) Plan ahead: A few years ago, I started using

Google Calendar to track all of our bills. If you have a Google account, it’s an easy place to keep track of regular income and bills. You can share calendars between email addresses. For example: Hubby and I can both add things to the calendar, and both view what bills are coming up in the next few weeks. You can set up repeating events {repeat bills}, and also track paycheck amounts. As we pay bills, I simply edit the calendar event, and we’re up-to-date on what bills have been paid, and what bills remain. It prevents us from double-payments {yes, it has happened} and late payments {that, too}. It is so much easier to look at one centralized place instead of going to each vendor’s individual website. This also allows us to plan ahead for special events. For example: if a birthday or dinner is on the calendar, we can plan to spend on those dates.

5) Choose your bank:

ING is my preferred banking vendor. We do utilize Chase simply for the convenience of deposits and ATM access. However, ING has the most user-friendly banking bill payment and savings account service. ING syncs with various companies to provide accurate, up-to-date amounts for bills due. ING also sends email alerts when payments have been sent. For example: as our mobile phone bill amount fluctuates, ING updates to correctly reflect the adjusted amount. In my opinion, it’s the most user-friendly banking bill payment service. Also, ING allows you to set up various savings accounts linked to your checking account. This makes setting individual savings goals a breeze.

Do you have tips/tricks that keep you financially fit? Please share!

Note: This is a series on the blog to share our path to financial fitness. We are no experts in personal finance. We are, however, on our way to becoming smart{er} consumers.xo,

PJ

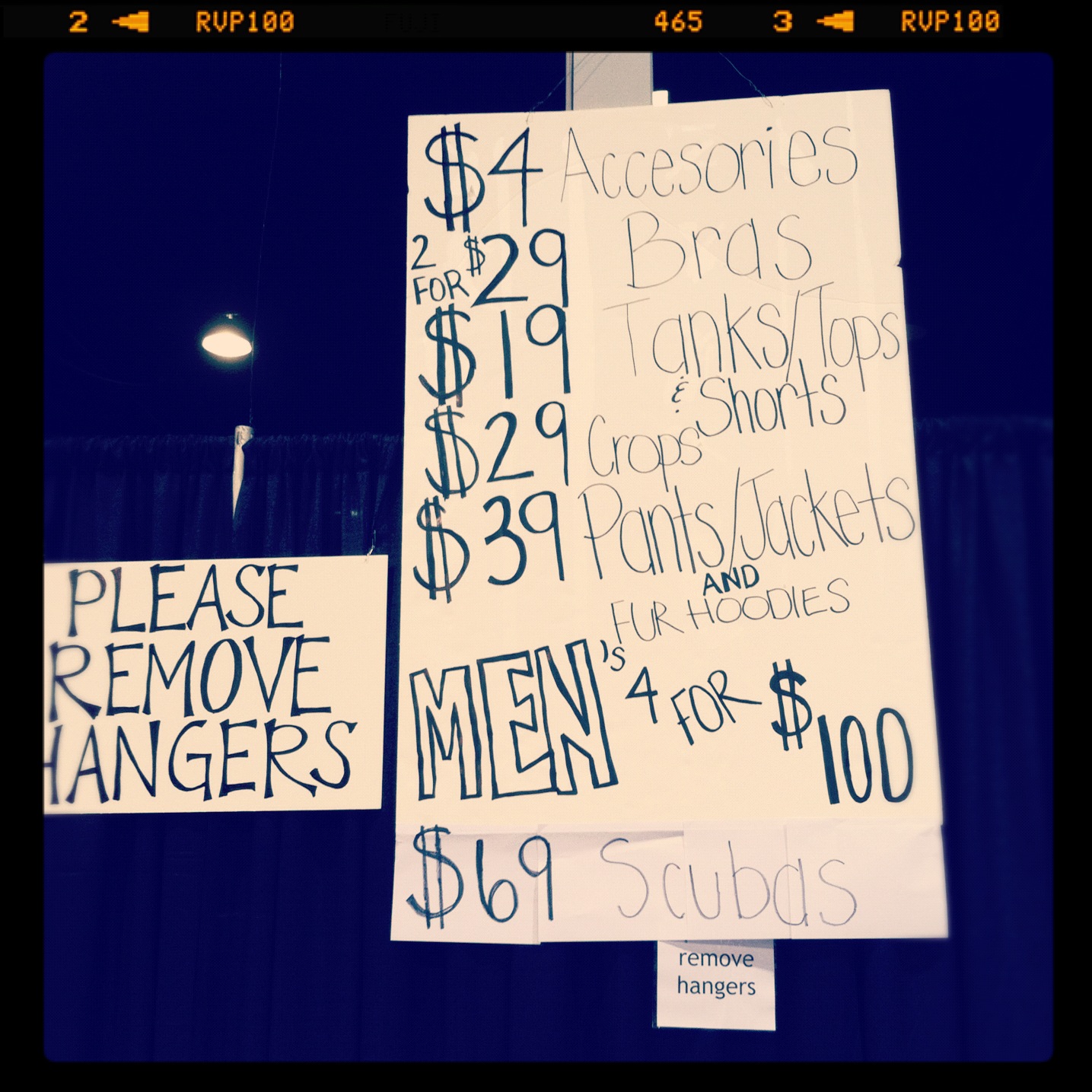

{Groove Pant // Regularly $98, Warehouse Price $39}

{Groove Pant // Regularly $98, Warehouse Price $39} {Fur Scuba Hoodie w/ removable fur // Regularly $148, Warehouse Price $39}

{Fur Scuba Hoodie w/ removable fur // Regularly $148, Warehouse Price $39} {organized racks of lululemon gear}

{organized racks of lululemon gear} {posted prices on the way to the fitting rooms}

{posted prices on the way to the fitting rooms}